6

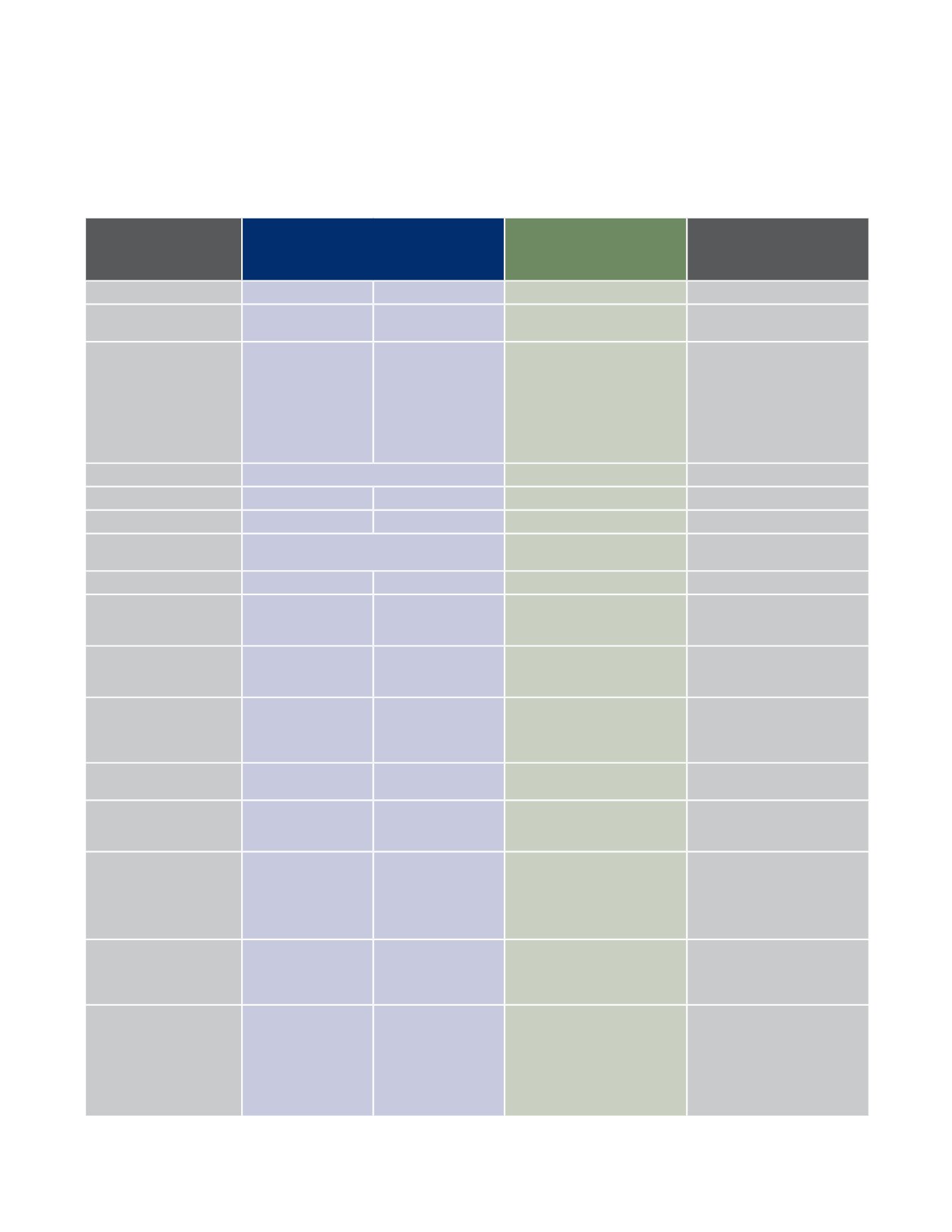

LAPRA Medical Plans At-a-Glance

The table below provides an overview of the key benefits provided through the LAPRA medical plans. Please refer

to the Anthem Blue Cross PPO or HMO, or Kaiser HMO materials for a complete description of benefits including

terms of coverage, exclusions and limitations.

Benefit Feature

Anthem Blue Cross

Prudent Buyer PPO

Anthem Blue Cross

CaliforniaCare Plus HMO

(California Residents Only)

Kaiser

HMO

(California Residents Only)

Providers

PPO Network Non-PPO Network

1

HMO Providers Only

3

HMO Providers Only

Calendar Year

Deductible

$300 per person

$600 per family

$500 per person

$1,000 per family

N/A

N/A

Calendar Year Out-of-

Pocket Maximum

(includes deductibles and

co-pays; excludes co-pays

for infertility benefits)

Medical Charges:

$2,000 per person

$6,000 per family (not

to exceed $2,000 for

any one person) See

page 7 for prescription

drug out-of-pocket

maximum.

Medical Charges:

$3,000 per person

$9,000 per family (not

to exceed $3,000 for

any one person) See

page 7 for prescription

drug out-of-pocket

maximum.

Medical and

Prescription Drug Charges:

$1,000 per person

$3,000 per family

Medical and

Prescription Drug Charges:

$1,500 per person

$3,000 per family

Lifetime Max

Unlimited

Unlimited

Unlimited

Office Visit

90%

2

70%

2

$15 co-pay

$15 co-pay

Hospitalization

90%

2

70%

2,4,5

100%

100%

Emergency Room

90%

2

after a $150 co-pay

(waived if admitted)

$150 co-pay

(waived if admitted)

$150 co-pay

(waived if admitted)

Urgent Care

90%

2

70%

2

$15 co-pay

$15 co-pay

Maternity Care

90%

2

70%

2

Doctor visits: $15 co-pay

(initial visit only)

Facility charges: 100%

Doctor visits: 100%

Facility charges: 100%

Well Baby/ Child Care

100%

(up to age 7; not

subject to deductible)

70%

2

(up to age 7; not

subject to deductible)

100%

(up to age 7)

100%

(up to age 2)

Routine Physical

100%

(adults & children over

age 7; not subject

to deductible)

Not covered

100%

(adults & children over age 7)

100%

Diagnostic X-ray

& Lab Tests

90%

2

70%

2

100%

100%

Body Scans

(not subject to

deductible)

100% after $25

co-pay; up to $250

per calendar yr

Not Covered

Not Covered

Not Covered

Physical & Occupational

Therapy and

Chiropractic Services

(additional services may be

authorized)

90%

2

(24 visits per calendar yr

combined PPO Network

& Non-PPO Network)

70%

2

(24 visits per calendar yr

combined PPO Network

& Non-PPO Network)

$15 co-pay

(limited to a 60-day period of

care after illness or injury;

additional visits available when

approved by the medical group)

$15 co-pay

(Chiropractic up to 40 visits per year)

Acupuncture

90%

2

(24 visits per calendar yr

combined PPO Network

& Non-PPO Network)

70%

2

(24 visits per calendar yr

combined PPO Network

& Non-PPO Network)

$15 co-pay

$15 co-pay

Mental Health/

Chemical Dependency

• Outpatient

• Inpatient

90%

2

90%

2

70%

2

70%

2,4,5

$15 co-pay

100%

$15 co-pay individual therapy/

group therapy: $7 co-pay

mental health,

$5 co-pay chem dep

100%

1

Benefits are based on the customary and reasonable charge. You are responsible for any difference between the amount charged and the

customary and reasonable charge, plus any deductible and/or coinsurance amount.

2

Subject to calendar year deductible.

3

Your primary care physician can refer you to a specialist when necessary and must approve all care you receive except in the event of an emergency.

4

Failure to obtain pre-service authorization may result in a $350 penalty.

5

Covered expense is reduced by 25% for services and supplies provided by a non-contracting hospital.